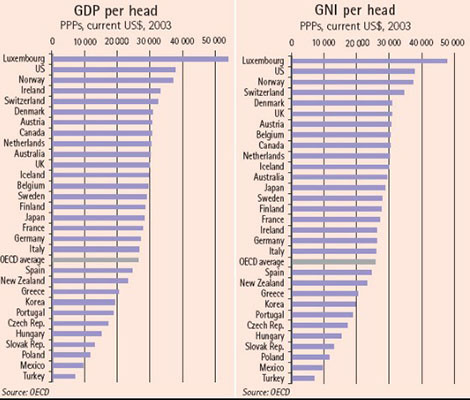

GDP and GNI

Ranking country performance is an interesting and useful exercise, but it can be misleading, in part because of what the indicators do not show.GDP is a perfect example of the muddle that reading league tables can cause. This is a relatively straightforward measure of output and gives an idea of how well-off a country is, compared with competitors and past performance. But it has to be handled carefully.

(617 mots)When is Germany going to be held to account for helping to cause the euro crisis?

When is the true story about Germany’s role in causing the euro crisis going to be properly told? For instance: Its banks over-lent (often recklessly), feeding the euro bubble over many years and loading countries like Spain and Ireland with private debt. Rather than take a hit from property market meltdowns and the like, Germany has managed to persuade its partners to repay its banks back using tax payers money via sovereigns.

(274 mots)Setting a poor standard

How seriously should you take ratings agencies such as Moody’s and Standard & Poor’s? One answer is “very”, since that is how governments and the media seem to treat them on the whole. Markets will likely react too, though exactly how and when is not as predictable. Broadly speaking, if the agencies downgrade you, media headlines will scream, policymakers could react. If they upgrade you, markets will see you as a safe bet for a big cheap loan.

(432 mots)Time to complete the EU banking market

The thing about this crisis is that people talk about fiscal policy this and quantitative easing that, but until the banks are fixed, the cause of the crisis will remain broken. And the banks won't be fixed until governments fix them.

(655 mots)

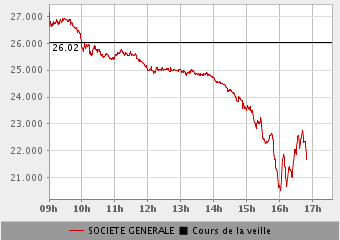

Soc Gen's share value plummets from around 26 euros per share down to around 21.55 at 5pm. A thin edge of a wedge or just more midsummer panic?

Soc Gen's travails

(1 mots)Recovery? What recovery?

Lots of people have just recently been talking as though the recovery in the US had been going on for two years. Not that anyone was celebrating, what with unemployment so high. Even so, I have no idea where that notion of recovery came from or what data it was based on, yet international organisations and other institutions seemed to have made up their minds. And many journalists and economic commentators seemed happy with that and took their cue from a few official press releases. In reality, the economy in the western world has been in fairly bad shape at least since Lehman's fall in 2008, and probably earlier than that.

(306 mots)Are rating agencies shooting markets in the foot?

Take a look at this chart listing the credit ratings by the main ratings agencies, including Standard & Poor's latest downgrade of the US to AA+ from AAA. Is S&P really saying that the US is a bigger sovereign risk than, say, the UK, and about the same as Belgium, where there is no government at all? (Incredibly, unlike the US, S&P does not have Belgium on their "observation" list, but as a safe AA+.)

(392 mots)

Archives

Issues » Economy